[ad_1]

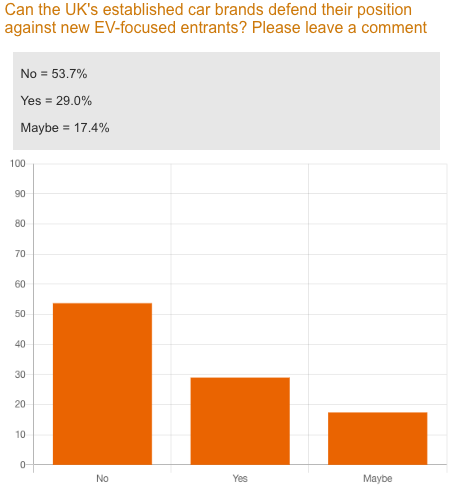

Over half AM’s readers (53.7%) consider the UK’s established automotive manufacturers will battle to defend their market share towards new electrical automobile (EV) focussed entrants.

New Chinese language manufacturers like BYD and GWM Ora have already launched within the UK and different new entrants like Omoda, Nio and B–ON are all lining as much as kick-start gross sales inside the subsequent 12 months.

Nevertheless, almost a 3rd (29%) of AM’s ballot respondents are extra optimistic about established unique tools producers’ (OEMs) possibilities to defend their place.

The remaining 17.4% have been undecided, with some citing that there are such a lot of elements at play that it’s troublesome to foretell what is going to occur or whether or not sure OEMs might be pushed out of enterprise.

Robert Forrester, Vertu Motors chief government, is definitely within the optimistic camp, telling AM in Might that: “All of the producers we signify have clear EV methods and to say the Chinese language manufacturers are the one ones which might be going to capitalise on EV is nonsense.”

Nevertheless, a number of the nameless feedback on the ballot consider in any other case.

One respondent stated: “There are such a lot of elements to contemplate, not least the provision of all supplies required for battery manufacturing and on the required scale going ahead which is already troublesome.

“The Chinese language OEMs seem to have this coated in abundance. European producers have to unfold their base to incorporate a mixture of inside combustion engine, electrical/hybrid and maybe most significantly hydrogen.”

One other respondent described the established OEMs as “letting their networks down by transferring to company”, which they consider the Chinese language manufacturers will capitalise on by sticking with a franchised supplier mannequin.

BYD is focusing on to increase to a community of 100 franchised sellers by 2025, Ora needs to ascertain 13 areas earlier than the top of 2023, Omoda needs over 50 dealerships within the UK earlier than its February 2024 launch and German electrical van model B-ON is trying to ascertain 25 areas earlier than 2024.

However not each new entrant is trying to associate with franchised sellers, with China’s premium focussed EV model Nio trying to mirror Tesla’s method (ET5 Touring mannequin pictured under) by coming into the UK with a direct to client digital-first mannequin.

One other AM reader stated altering client attitudes to vehicles and mobility typically will play in favour of the brand new disruptor manufacturers.

They stated: “The final commoditization of the sector, lack of brand name funding and differentiation from OEMs will solely speed up this development, particularly within the mid-market quantity sector.”

Pricing may also be an essential issue, one thing that MG has capitalised effectively on to ascertain itself rapidly as a superb worth proposition within the EV area.

MG has grown by 58% within the first six months of 2023 and brought over 3% market share within the UK.

An AM reader stated: “If the brand new Chinese language manufacturers and disruptors can launch merchandise with wise pricing this may put strain on the established manufacturers.

“Many mainstream EV costs are already in status value territory and out of attain of most individuals.”

This doesn’t appear to be the present technique of manufacturers like Ora, which is priced from £31,995, which is comparative with fashions just like the Vauxhall Corsa-e.

Likewise, the BYD Atto 3 is priced from £37,695, which has similarities to one thing like a Kia Niro EV.

One of many AM ballot respondentsbelieves OEMs will defend their place and stated: “Ora & BYD have didn’t make any impression available in the market up to now.”

One other stated that the established OEMs are additionally very EV-focussed and have UK market expertise, technician data and analysis and improvement budgets to compete alongside any new entrants to the market.

Established OEMs may also shield their market share by having a “sturdy ecosystem of help for patrons of latest EVs”.

One ballot respondent stated: “Help with recommendation on adoption, residence charging and EV possession will rapidly turn out to be a USP for them within the face of latest entrants who could have but to ascertain partnerships in these areas.

“The extra they will help new EV prospects with their transfer to electrical, the extra seemingly that buyer might be prepared to buy from them now and going ahead.”

[ad_2]