[ad_1]

Income will increase 12% year-over-year to $45 billion; web revenue ($1.9 billion) and adjusted EBIT ($3.8 billion) additionally larger; money and liquidity persistently sturdy

Ford confirmed focus, velocity and accountability in producing stable second-quarter 2023 working outcomes, whereas taking strategic actions which are anticipated to assist create a high-performing enterprise and long-term worth for all stakeholders.

“The shift to highly effective digital experiences and breakthrough EVs is underway and going to be risky, so having the ability to information clients via and adapt to the tempo of adoption are large benefits for us,” mentioned Ford CEO Jim Farley. “Ford+ is making us extra resilient, environment friendly and worthwhile, which you’ll see in Ford Professional’s breakout second-quarter income enchancment (22%) and EBIT margin (15%).”

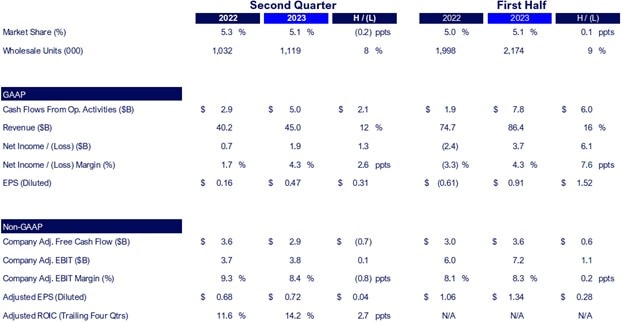

Firm Key Metrics Abstract

Ford was once more America’s top-selling model within the quarter – web gross sales elevated greater than 11% – and for the primary six months of 2023. Worldwide, demand for Ford’s contemporary lineup of vans, SUVs and business vans pushed second-quarter income up 12%, to $45 billion. Quarterly web revenue was $1.9 billion, practically 3 times larger than within the year-ago interval and a 4% margin. Adjusted earnings earlier than curiosity and taxes, or EBIT, grew to $3.8 billion or 8.4% of income.

Money movement from operations and adjusted free money movement continued to be sturdy, at $5.0 billion and $2.9 billion, respectively. So was Ford’s steadiness sheet, with practically $30 billion of money and greater than $47 billion of liquidity on the finish of Q2, each of them up sequentially and year-over-year.

CFO John Lawler reiterated that the corporate has ample sources to concurrently fund disciplined funding in progress and return capital to shareholders – for the latter, focusing on 40% to 50% of adjusted free money movement. On July 13, Ford’s board of administrators declared the most recent common dividend of 15 cents per share, payable Sept. 1 to shareholders of file on the shut of enterprise on July 25.

Enterprise Section Highlights

Within the second quarter, Ford Professional – with a profitable mixture of autos, software program and companies that generates worth for business clients and pricing energy for Ford – turned 8% progress in product shipments right into a 22% soar in income. The enterprise unit’s $2.4 billion in EBIT was greater than twice its profitability a yr in the past and represented a 15% margin.

Buyer deliveries of the all-new Tremendous Obligation work truck had an instantaneous impact on Ford Professional’s efficiency, with quarterly U.S. gross sales of Tremendous Obligation up 28%. International income from each gas-powered Transit and electrical E-Transit business vans was additionally up.

Business clients are additionally beneficiaries of Ford’s digital innovation and quickly increasing software program and companies. Ford Professional accounts for greater than 80% of the corporate’s practically 550,000 paid software program and companies subscribers, to this point, together with options for fleet administration, telematics and EV charging.

Ford Blue – which engineers, makes and sells extremely common gasoline and hybrid autos, together with specialised spinoff fashions – improved its efficiency in each area.

The enchantment and pricing energy of Ford Blue’s iconic merchandise helped account for progress in wholesales and income, and $2.3 billion in EBIT. Section initiatives to enhance high quality and cut back prices are anticipated to additional increase its effectiveness and profitability over time.

In Could, Ford Blue and Ford Professional collectively launched the absolutely redesigned, extremely related 2024 Ford Ranger. Ranger is a crucial a part of Ford’s international pickup management and is bought in additional than 180 markets.

Income from Ford Mannequin e’s first-generation electrical autos elevated 39% within the second quarter; sequentially, income extra doubled.

“The near-term tempo of EV adoption shall be just a little slower than anticipated, which goes to profit early movers like Ford,” Farley mentioned. “EV clients are model loyal and we’re profitable plenty of them with our high-volume, first-generation merchandise; we’re making good investments in capabilities and capability world wide; and, whereas others try to catch up, we have now clean-sheet, next-generation merchandise in superior growth that can blow folks away.”

Farley mentioned that Ford now expects to succeed in a 600,000-unit EV manufacturing run charge throughout 2024 and can keep flexibility, balancing progress and profitability, on the best way to attaining a two-million run charge.

Final week, citing growing manufacturing capability on the Rouge Electrical Automobile Heart in Michigan, continued work on price scaling and enhancing costs for EV battery uncooked supplies, Ford introduced decrease urged retail costs for the all-electric F-150 Lightning pickup truck.

In April, Ford Mannequin e introduced a plan to remodel Ford’s current advanced in Oakville, Ont., Canada for high-volume EV manufacturing – assembling battery packs and putting in them in next-generation electrical autos produced on the identical campus.

Additionally throughout the second quarter, the corporate:

- Opened the Ford Cologne Electrification Heart in Germany, its first carbon-neutral manufacturing facility and residential of the forthcoming, all-new Ford Explorer for Europe

- Accomplished capability growth for the Mustang Mach-E in Cuautitlan, Mexico, and initiated one other enlargement of the Rouge facility

- Made substantial progress on building of a next-generation EV pickup plant in West Tennessee, and three joint-venture battery manufacturing amenities in Tennessee and Kentucky, and

- Began website preparation for a wholly-owned plant in Michigan that can produce lithium iron phosphate, or LFP, EV batteries.

The in-company Ford Mannequin e startup can also be liable for superior digital platforms and software program throughout all Ford product strains. A main instance is the BlueCruise Degree 2 superior driver-assistance system, which via the primary half of 2023 had enabled greater than 1.4 million hours of hands-free driving for patrons throughout North America.

Ford Credit score generated earnings earlier than taxes of $390 million, down from a yr in the past, as anticipated, reflecting decrease financing margin, the nonrecurrence of credit score losses reserve releases and a decline in residual values of leased autos – all of which have been anticipated within the firm’s full-year outlook.

Lawler mentioned the Ford+ plan is designed to show nice worth for patrons into the identical for shareholders and different stakeholders by “breaking Ford out of the cycle of low margins and excessive capital that’s typified conventional automakers for method too lengthy.”

“We’ve acquired large ambitions, our method is completely different from anybody else’s and we’re doubling down the place we have now aggressive benefits – in vans, SUVs and business vans,” he mentioned. “We predict doing that, elevating high quality and reducing prices can earn us the sort of worthwhile progress and valuation that best-in-class, technology-led industrial corporations command.”

Outlook

Ford is lifting its steerage vary for full-year 2023 consolidated adjusted EBIT to between

$11 billion and $12 billion. Likewise, the corporate is elevating its expectations for full-year adjusted free money movement to between $6.5 billion and $7 billion, with capital expenditures of between $8 billion and $9 billion.

The steerage presumes:

- Headwinds together with international financial uncertainty and inflationary pressures, larger industrywide buyer incentives and continued EV pricing strain, elevated guarantee prices, decrease previous service pension revenue, change charges and prices related to union contract negotiations, together with

- Tailwinds comprising an improved provide chain, larger trade volumes, upside from the all-new Tremendous Obligation and decrease commodity prices.

For its clear, customer-centered enterprise items, Ford now expects full-year EBIT:

- Approaching $8 billion for Ford Professional, greater than double in 2022, from important year-over-year enchancment in pricing and quantity

- Of about $8 billion from Ford Blue, with larger volumes and stronger combine greater than offsetting any potential pricing headwinds, and

- To be a lack of about $4.5 billion for Ford Mannequin e, reflecting the pricing surroundings, disciplined investments in new merchandise and capability, and different prices.

Full-year EBT for Ford Credit score is anticipated to be about $1.3 billion.

The corporate plans to report third-quarter 2023 monetary outcomes on Thursday, Oct. 26.

SOURCE: Ford

[ad_2]