[ad_1]

The restoration in used electrical automobile (EV) values has continued to assemble tempo in October because of the mixture of accelerating client demand for greener automobiles in accordance with Auto Dealer’s Retail Value Index.

Fuelled by enticing costs and a softening within the current surge in provide of second-hand EVs coming into the market, the common retail worth of a used EV has elevated 0.6% thus far in October on a month-on-month (MoM) and like-for-like foundation with costs at £32,203.

In September costs have been flat MoM, which adopted 12 consecutive months of decline. Whereas costs are nonetheless down on a year-on-year (YoY) foundation, the stabilising market leaves costs -19.6% down YoY – the shallowest charge of YoY decline since June.

At 0.6%, the month-to-month worth progress for EVs is barely forward of the 0.2% MoM enchancment for petrol values, however slightly below the 0.7% month-to-month enhance for diesels. On an annual foundation ICE automobiles stay properly forward of their electrical counterparts, with present petrol and diesel costs up 1.3% YoY (£16,315) and 0.8% YoY (£16,000) respectively.

The rise in used EV costs is being fuelled by beneficial market dynamics, with ranges of client demand outpacing provide ranges on Auto Dealer’s on-line market. Demand for used EVs is up 78.4% thus far in October – far forward of petrol (up 2%) and diesel (down -1.1%). What’s extra, used EVs are taking simply 23 days to go away the forecourts, the quickest since December 2018 and virtually per week sooner than the 28-day common for the used market total.

Crucially, while demand progress is accelerating, the general charge of provide progress of used EVs is softening, falling from a rise of 115% YoY in August, and 57% in September, to a rise of simply 24.3% thus far this month. This imbalance is just not solely serving to to stabilise costs, but additionally enhance potential profitability, as highlighted by Auto Dealer’s Market Well being metric, which for second-hand EVs is up 43.5% YoY thus far in October. It marks the strongest Market Well being rating for second-hand electrical vehicles since March 2022, and is properly forward of the in any other case wholesome 3.7% YoY rise in total used automobile Market Well being.

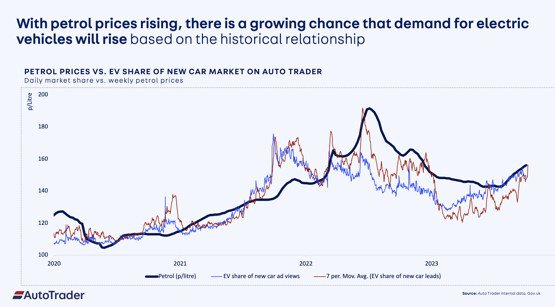

Commenting, Richard Walker, Auto Dealer’s information and perception director, stated: “The continued realignment in used electrical pricing is the true stand-out thus far in October, with one other month of enchancment after a yr of decline. For the second we’re seeing the celebrities align for second-hand EVs; higher affordability and rising costs on the pumps helps to make them a extra viable different to their ICE counterparts that are nonetheless growing in worth. The mix of accelerating demand with softening provide is sweet information for retailers; though the market stays unstable, for many who comply with the information to seek out and worth the best inventory for his or her forecourts, EVs at the moment characterize actual revenue potential.”

Though softening on current highs, he stated the amount of electrical automobiles coming into the second-hand market stays sturdy, due largely to the continuing de-fleeting of the circa 750,000 new EVs purchased during the last three years. This issue has been the primary contributor to the current contraction in values amongst youthful aged automobiles by flattening the general common worth ranges of all sub-3-year-old vehicles. The decline within the retail worth of used vehicles lower than a yr previous deepened in mid-October to -2.9% YoY from -2.5% in September, while 1–3-year-old vehicles are at the moment down -6.7% YoY, which was the identical charge of decline recorded final month.

Walker defined that it’s this fall in youthful automobile values which is driving the -0.6% YoY easing of used automobile costs total to £17,778 within the yr to mid-October. Nonetheless, the general well being of the market is underlined by the 0.8% enhance in costs on a MoM foundation, which is in step with typical seasonal developments, and the huge 44% worth progress on pre-pandemic ranges in October 2019. That is additional highlighted by the truth that total present ranges of client demand on Auto Dealer is up 5.7% on the identical interval final yr, in addition to the present velocity wherein used vehicles are promoting: at 28 days it’s the quickest since Might, and sooner than the 29 days taken in September and 30 in October 2022.

The headline decline continues to masks a extremely nuanced market. While newer automobile costs are contracting, on the older finish of the market, 10–15-year-old used automobile costs maintained double-digit worth progress, rising 10.2% year-on-year and a couple of.2% over the month. 5- to 10-year-old automobile costs are in the meantime up a strong 2.5% YoY.

[ad_2]