[ad_1]

Auto Dealer’s newest market well being figures reveal pockets of profitability with 1–3-year-old vehicles having fun with an enormous 35% rise as a result of a 16.1% enhance in demand far outpacing December’s 14.3% fall in provide.

Vehicles aged between 3–5-year-old got here in second by way of efficiency up 19.3% though older 5-10 year-old classes softened 0.4% whereas 10-15 yr outdated autos fell 7.4% as provide exceeded in any other case constructive demand.

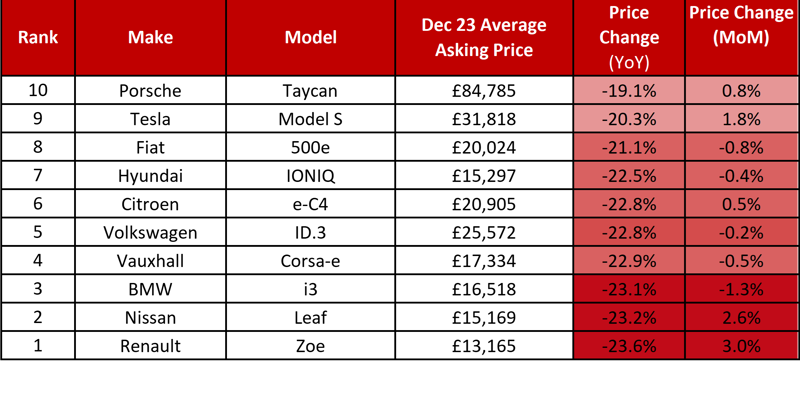

By gasoline sort, all autos confirmed progress though electrical autos stood out in December as an enormous 103.2% rise in demand far exceeded a 7.2% rise in provide, propelled by the current fall in costs.

Auto Dealer stated December’s efficiency meant that the used automobile market had entered 2024 on a agency footing, with client demand, pace of sale, and transactions in a sturdy place. Going forwards, it predicts strong used automobile demand will proceed all year long and ship a small market uplift with forecast transactions rising to round 7.24 million gross sales.

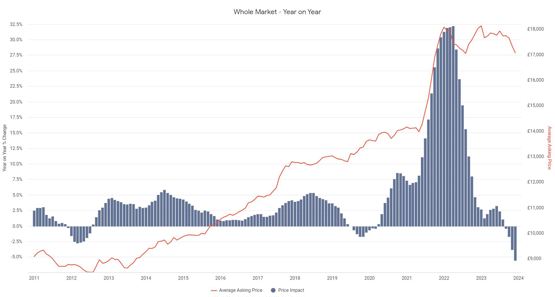

Even so, Auto Dealer’s Retail Worth Index signifies retail values contracted -5.6% on a year-on-year and like-for-like foundation final month to £17,064, suggesting current traits in commerce costs at the moment are flowing by means of into the retail market.

Shopper demand remained strong all through December, rising 11.7% YoY – up from 8.6% in November, the strongest tempo of progress since July. Mixed with a slight softening within the fee of provide to only 1% YoY progress, Auto Dealer’s Market Well being metric – which assesses market profitability primarily based on provide and demand dynamics – elevated from 6% in November to 10.6% in December, additionally the best since July. This translated into gross sales too; Auto Dealer’s proxy information level to circa 4% enhance in used automobile transactions final month.

Buoyant client urge for food was additionally mirrored within the site visitors to Auto Dealer’s market, which in December noticed a complete of over 67 million cross platform visits, which is a ten.2% YoY enhance. Momentum continued into the New Yr with visits up almost 4% in the course of the first week of January, while the variety of day by day distinctive customers rose by almost 1.5% YoY to circa 1.4 million. Moreover, used vehicles proceed to promote shortly; in December it took a median of simply 36 days for a automobile to promote, which is identical as in 2022.

With promising indicators of strain starting to ease on customers, not least the much-improved GfK Shopper Confidence Barometer in December in addition to the 14% YoY enhance in visits to its market in 2023, Auto Dealer is predicting that strong used automobile demand will proceed in 2024 and lead to a small market uplift. It forecasts transactions will enhance to an estimated 7.24 million gross sales.

With promising indicators of strain starting to ease on customers, not least the much-improved GfK Shopper Confidence Barometer in December in addition to the 14% YoY enhance in visits to its market in 2023, Auto Dealer is predicting that strong used automobile demand will proceed in 2024 and lead to a small market uplift. It forecasts transactions will enhance to an estimated 7.24 million gross sales.

It stated that these indicators of robust client demand additional underline the necessity for retailers to comply with the retail market. In response to Auto Dealer estimates, some 51,633 vehicles are presently being priced beneath their market worth by 8,100 retailers. With strong client demand available in the market, this repricing exercise is doubtlessly costing retailers £35.8 million in misplaced earnings – almost £4,500 per retailer.

December marked the fourth consecutive month of YoY decline for retail costs though as in earlier months there was appreciable nuance within the information because the development of fleet destocking pushed down 1–3-year-old costs 10.1% yr on yr to £24,806. Used vehicles greater than 10 years outdated demonstrated constructive worth progress, with 10–15-year-old autos up 5.3% YoY to £6,532 and 15 yr+ autos rising 2.5% to £5,516. Vehicles aged 3-5 years outdated slid 6.1% to £19,639.

Amongst gasoline sorts, the typical price of a used EV was down 22.7% to £29,718 – persevering with the development of a lot bigger falls than petrol down 3.8% to £15,482 YoY and diesel which fell 2.2% to £15,371.

Commenting, Auto Dealer’s director of information and insights Richard Walker stated: “Our information clearly exhibits that the basics of the used automobile market stay stable; client demand is powerful, and vehicles are promoting shortly, which mixed with the gradual return in provide, means retail costs proceed to point out extra resilience than their commerce counterparts.

Commenting, Auto Dealer’s director of information and insights Richard Walker stated: “Our information clearly exhibits that the basics of the used automobile market stay stable; client demand is powerful, and vehicles are promoting shortly, which mixed with the gradual return in provide, means retail costs proceed to point out extra resilience than their commerce counterparts.

“Worryingly, it seems some pricing methods are being guided by wholesale traits, inserting pointless strain on retail values, and risking earnings within the course of. Reasonably than only a trigger for concern, the retail and wholesale markets being out of sync additionally presents a revenue alternative for retailers who analyse the information on a car-by-car foundation and worth inventory relative to retail valuations. This yr greater than ever, it’s essential retailers undertake a forensic-like method to their pricing methods.”

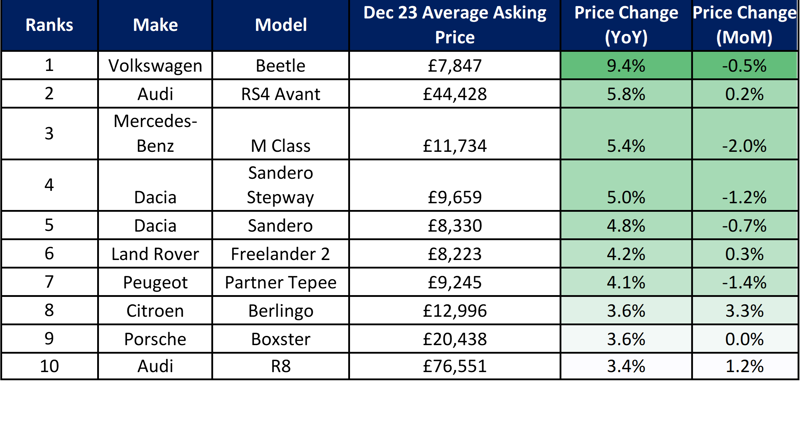

Prime 10 used automobile worth progress (all gasoline sorts) | December 2023 vs December 2022 like-for-like Prime 10 used automobile worth contraction (all gasoline sorts) | December 2023 vs December 2022 like-for-like

Prime 10 used automobile worth contraction (all gasoline sorts) | December 2023 vs December 2022 like-for-like

[ad_2]