[ad_1]

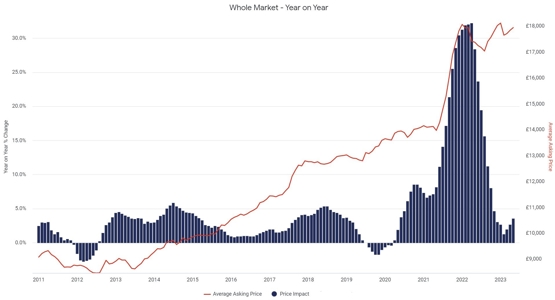

Used retail costs have elevated by 3.6% year-on-year on a like-for-like foundation, in line with Auto Dealer’s newest information.

The corporate’s newest Retail Worth Index, which is predicated on circa 900,000 day by day pricing observations, exhibits the present common worth of a used automotive is £17,946, which equates to a 3.6% year-on-year (YoY) improve on a like-for-like foundation.

It marks the best price of development since November 2022, and the third consecutive month the speed of development has elevated, rising from 2.7% YoY in April, and a couple of% YoY in March.

Though the speed of development is down on the height of 32.2% YoY in April 2022, this present price is on prime of the large 28.4% YoY improve recorded in Might 2022.

Unusually for this time of yr, when costs sometimes soften (eight out of the final 12 years), present common costs have additionally elevated month-on-month (MoM), rising 0.6% on April. It makes Might the fifth consecutive month of MoM development.

Auto Dealer mentioned retail values have remained sturdy because of the ongoing demand and provide dynamics available in the market.

Present ranges of demand are sturdy, which is mirrored within the very sturdy client engagement on Auto Dealer.

Certainly, the primary half of Might has seen a 13% YoY improve in visits to {the marketplace}.

Reassuringly, this uplift in demand is translating into used automotive gross sales, which in line with Auto Dealer’s sales-proxy information, had been up circa 4% YoY in April, and follows the 4.1% improve in used automotive transactions recorded within the first quarter of this yr.

One other indicator of client demand is the pace through which used vehicles are leaving retailers’ forecourts.

Auto Dealer’s information exhibits that used vehicles are presently taking a median of simply 27 days to promote, which is stage with April, however seven days sooner than Might final yr (34), and effectively forward of pre-pandemic averages.

The enterprise mentioned this sturdy stage of demand available in the market, coupled with the continuing shortfall in inventory (down -6.7% YoY), shouldn’t be solely maintaining used automotive costs steady, however can also be supporting a wholesome and worthwhile gross sales market.

In reality, Auto Dealer’s used automotive Market Well being metric is up 12.5% YoY this month. Given there isn’t a signal of an imminent change to those market dynamics, the outlook for used automotive costs stays considered one of stability.

Richard Walker, Auto Dealer’s information and insights director (pictured), added: “Over the previous couple of months we’ve seen an acceleration in retail worth development, from each a year-on-year and month-on-month perspective.

“This not solely exhibits the present power of the used automotive market, but in addition how vital it’s to maintain a detailed eye on dwell retail costs to drive essentially the most revenue out of each sale.

“With commerce values not according to retail, this additional strengthening in retail costs is offering sturdy margin potential.”

Retail Worth Index – mid-Might 2023

Electrical costs down on final yr, however are up on April

Regardless of recording a optimistic YoY and MoM development, common used automotive costs are being impacted by the continuing contraction in used electrical car (EV) values (£31,585), which as of mid-Might, are down -17.3% on the identical interval final yr.

Since January, common costs have fallen circa £4,600, and since reaching a peak in July 2022, are down circa £9,200.

In distinction, the typical worth of a used petrol (£16,365) and diesel (£16,556) is presently up 6% and 4.3% respectively towards Might 2022.

Though Might marks the fifth consecutive month of YoY contraction, the speed through which costs are falling has begun to melt, slowing from the -18.1% recorded in April.

What’s extra, following eight consecutive months of decline, common electrical costs have elevated on a MoM stage, rising 0.2% on final month.

Whereas the speed of used EV inventory getting into the market continues to outweigh the sturdy ranges of client urge for food, there are indicators the imbalance is starting to stage off.

Provide development has eased from a excessive of 303% YoY in January, to 211% in Might, whereas demand on Auto Dealer has elevated from 40% to 45% over the identical interval.

Walker added: “Whereas there’s nonetheless a major imbalance of provide and demand available in the market, we’re starting to see optimistic indicators of it stabilising.

“Nevertheless, it’s nonetheless early days – there’s presently round 15,000 used EVs on the market on Auto Dealer on daily basis, which is up from simply 5,000 a yr in the past.

“Though this enormous surge in provide is forcing a correction in costs, the higher vary of reasonably priced decisions for automotive consumers helps to gas a strong improve in client demand, and with it some promising alternatives for retailers.”

[ad_2]