[ad_1]

Practically six months into its Accelerator crowdfunding program, photo voltaic EV startup Aptera is placing a pause on new investments whereas it information requested paperwork with the Securities and Change Fee (SEC). Consequently, lots of the loyal believers that make up the Aptera group and have helped get the corporate this far will not have the ability to make investments until they meet sure standards.

Aptera first launched the Accelerator Program in late January, one week after formally debuting the Launch Version model of its flagship photo voltaic EV. The distinctive program allows reservation holders to put money into Aptera in change for a secured manufacturing slot of the primary 2,000 photo voltaic EVs off the meeting line. In return, that funding empowers the startup to buy preliminary manufacturing tools to be paid again via an awarded grant from the California Power Fee (CEC).

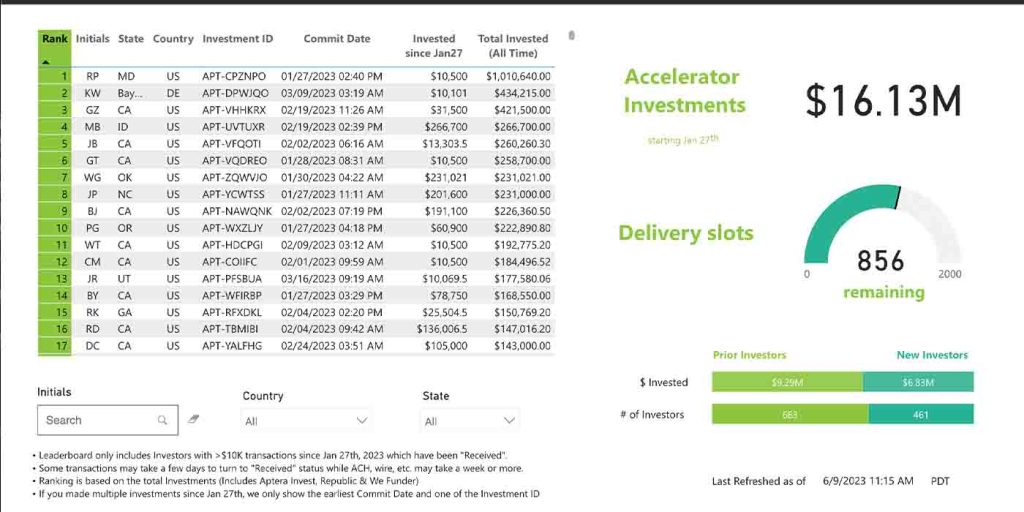

By February, Aptera introduced it was extending this system with out finish till all the Launch Version photo voltaic EVs had been spoken for. We have now adopted this system’s progress and reported again to you alongside the best way. To this point, over 1,110 people have dedicated to investing at the least $10,000 every, for a complete eclipsing $16 million.

Though over 850 construct slots nonetheless stay, Aptera shared that it’s halting the Accelerator program this weekend, however there may be nonetheless time to take a position.

Aptera will quickly solely enable accredited folks to take a position

An electronic mail signed by co-founders Chris Anthony and Steve Fambro went out to reservation holders right now stating the next:

Loads is going on at Aptera proper now and we’re transferring swiftly to convey photo voltaic mobility to the lots. By the Accelerator Program, we’ve surpassed our crowdfunding expectations and over 1,100 trailblazers have joined the trouble to speed up Aptera’s path to manufacturing.

To proceed our Crowdfunding, the SEC requires us to quickly pause and file up to date documentation. We wished you to know first that the window for investing in Aptera as a non-accredited investor can be closing quickly. We are going to solely proceed to simply accept investments from non-accredited traders right here till midnight PDT on Sunday, June 11, 2023.

Throughout this momentary pause, we’ll nonetheless take investments from accredited traders via a Reg D providing at make investments.aptera.us. So, if you wish to be part of the longer term and are an accredited investor, you continue to can make investments throughout this time.

We’re humbled by the help of so many individuals who share our dedication to creating a greater future for folks and our planet.

Aptera was not tremendous particular about what kind of information and documentation must be up to date with the SEC, however the concept of being funded by frequent folks believers who need to put money into photo voltaic mobility doesn’t look like sitting proper with Uncle Sam.

As a substitute, accredited traders would be the solely ones allowed to take part in funding the startup following Sunday’s sudden deadline. In accordance with the SEC web site, one should match the next standards to say standing as an accredited investor:

- Monetary standards

- Internet value over $1 million, excluding main residence (individually or with partner or companion)

- Revenue over $200,000 (individually) or $300,000 (with partner or companion) in every of the prior two years, and fairly expects the identical for the present 12 months

- Skilled standards

- Funding professionals in good standing holding the overall securities consultant license (Collection 7), the funding adviser consultant license (Collection 65), or the non-public securities choices consultant license (Collection 82)

- Administrators, govt officers, or normal companions (GP) of the corporate promoting the securities (or of a GP of that firm)

- Any “household shopper” of a “household workplace” that qualifies as an accredited investor

- For investments in a non-public fund, “educated staff” of the fund

It will likely be attention-grabbing to see how this all performs out and the way Aptera responds to this sudden pause in crowdfunding. As one of the refreshingly clear startups within the EV world right now, Aptera’s founders have spoken fairly brazenly concerning the startup’s steady want for funding as a way to attain that holy grail that’s scaled photo voltaic EV manufacturing.

Because the Accelerator program started, there was a gradual and constant trickle of newcomers becoming a member of to take a position, so it’s a disgrace that Aptera won’t get to see it via to promoting out its first batch of automobiles, at the least to not these of us who aren’t millionaires (but).

It is going to now be as much as the professionals and their checkbooks to see Aptera over the end line. Keep in mind, there’s nonetheless time, although. Non-accredited people can nonetheless make investments till Sunday, and as at all times, you’ll be able to nonetheless reserve an Aptera of your personal with out the $10,000 dedication.

FTC: We use revenue incomes auto affiliate hyperlinks. Extra.

[ad_2]