[ad_1]

As introduced throughout Price range 2024, the federal government is ready to improve the service tax from the 6% fee at current to eight% as of March 1. There are a couple of classes which can be excluded from the brand new fee, together with F&B and telecommunications, however generally, customers are set to pay extra because of the hike.

It has already been indicated that car servicing and repairs don’t fall underneath exempted classes underneath the revision, and so car upkeep is ready to value extra from March 1. Keep in mind that the service tax on this case is just utilized to labour costs and never on the components themselves.

In any case, the enjoyable doesn’t actually finish there, as a result of one other space the place motorists are set to pay extra is motor insurance coverage. Nothing has actually been highlighted about this within the information to date, however the phase will certainly see the two% improve being utilized on it, as all business-to-consumer basic insurance coverage or takaful, excluding medical insurance coverage or medical takaful is topic to service tax.

Will it value you considerably extra? Properly, not fairly, though it relies on the protection or relatively how a lot you really should fork out for the premium itself. The service tax for motor insurance coverage is charged on the precise premium paid, which suggests it’s calculated on the sum after NCD, if any, is utilized.

Taking the resident Honda CR-V’s 2023 insured sum of RM96,200 for instance, the service tax is RM102.84 on a premium costing RM1,713.97 (after making use of 55% NCD). That’s at 6%, and for those who apply an 8% fee on the premium to get a gauge of how issues form up, the service tax could be RM137.12, which is an additional RM34.27.

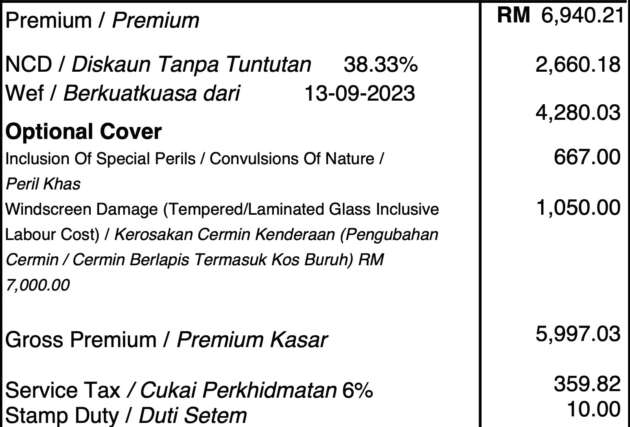

One other instance is supplied by Hafriz’s Vary Rover Sport, for which he presently pays RM5,997 (with 38.33% NCD utilized) in insurance coverage. The service tax for that’s RM359.82, and this might improve to RM479.77 if calculated with an 8% fee, translating to an extra RM119.95.

As it’s with servicing prices, the margin of improve from a standalone viewpoint isn’t drastic (except labour costs are exorbitant and the car you’re insuring is properly, costly), however like with the improve within the electrical energy tariff for customers who use between 601 kWh and 1,500 kWh a month, it represents further, unavoidable spend, and it’ll add up.

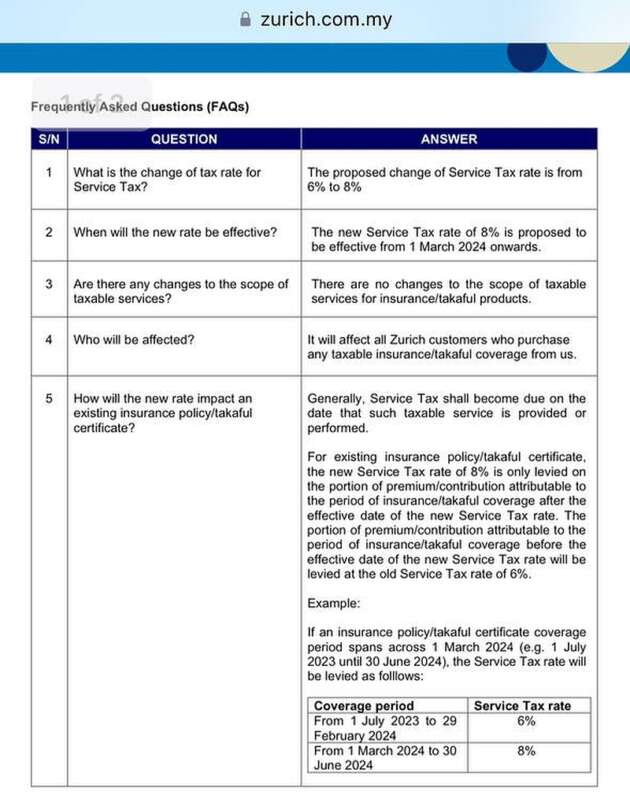

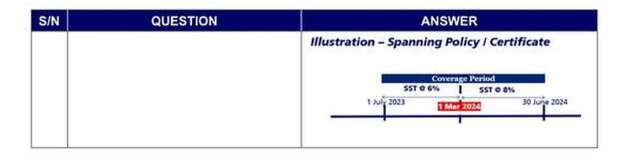

Relating to the applying of the brand new service tax fee, right here’s an fascinating bit – customers may very well should pay extra for his or her present motor insurance coverage if protection runs by way of March 1, if that in an FAQ by Zurich Malaysia is true.

The FAQ notes that the tax can be utilized partially on present insurance policies, the place a coverage with a protection interval from July 2023 to June 2024 will see the period of protection from March 1 to the top of the protection interval in June being topic to the service tax improve.

It’s not recognized whether or not it’s blanket throughout all suppliers, nevertheless it it trying more likely to be the case, as an MSIG publish on its Fb web page notes the rise within the service tax in addition to the next statement:

“MSIG reserves the appropriate to gather any undercharged service tax for insurance policies processed earlier than 1 March 2024 the place the insurance coverage interval spans throughout 1 March 2024. You might be obligated to pay any relevant taxes together with however not restricted to service tax and stamp obligation which can be imposed by the Malaysian tax authorities in relation to your coverage.”

Ought to this be the case, the query could be, whereas the calculation can be pro-rated, how precisely will coverage holders pay for the adjustment? We’ve got reached out to PIAM to seek out out extra about this, and can replace after we get additional info.

Trying to promote your automotive? Promote it with myTukar.

[ad_2]