[ad_1]

Client champion Martin Lewis’s free instrument for shoppers to probe whether or not they have been victims of discretionary fee agreements (DCA) has logged the submitting of over half one million complaints.

“Final Tuesday,” he wrote in his weekly e-mail to subscribers, “we launched our model new automotive finance hidden fee reclaiming information & instrument and… wow! In simply seven days you have despatched over 530,000 grievance emails by way of it.”

“The regulator,” he provides, “the Monetary Conduct Authority (FCA), estimates 40% of finance agreements had these dodgy fee preparations (you will not know in case you did because it was hidden) and the common payout per association could also be £1,100. In order that doubtlessly equates to as much as £234 million coming again to individuals.”

The Cash Saving Skilled founder beforehand stated he was following the FCA’s assessment of historic DCAs intently: “We do not imagine it doubtless the FCA would do that except it has substantial proof, so a payout is probably going due when it studies in September. But as claims could possibly be time-barred … the earlier you complain, the safer.”

The FCA launched its assessment after the Monetary Ombudsman Service dominated in two circumstances that lenders’ DCAs, mixed with an absence of full disclosure to the client, had put automotive patrons at a drawback and have been unfair. The FCA stated it hopes to shortly decide if this can be a widespread problem and introduced that it was sending in an unbiased professional to seek the advice of with automotive loans companies.

Beforehand, Lewis stated: “I feel it is vitally very doubtless it’s going to rule that there was seismic, systemic mis-selling. A again of the envelope calculation reveals this may doubtless find yourself being the second largest ever UK reclaim marketing campaign, after PPI.”

“I feel it doubtless that, when the investigation completes (at the moment deliberate to be September), the FCA will arrange some sort of mass-scale redress scheme – although there is a small likelihood it’s going to change its thoughts and say this can be a damp squib. The easiest way to behave is to imagine that scheme is coming.

“Regardless that there is a pause on companies needing to cope with complaints, it’s vital to get your grievance logged sooner, so there’s much less likelihood you’ll be timed out.”

Lewis reported that the variety of emails despatched to automotive finance suppliers since Cash Financial savings Skilled launched its instrument has been unprecedented. “Many companies merely weren’t ready. Nonetheless, most of the massive companies have assured that they may be capable of acknowledge response of your e-mail inside the 28 days. So, if you have not had an acknowledgement but, do not be too involved, they’re doubtless simply swamped.”

Zoe Morton, affiliate director at RSM UK, stated: ‘The potential affect of the FCA’s assessment into discretionary fee preparations is huge, very like Fee Safety Insurance coverage (PPI) was, so it’s no shock the FCA has put complaints on maintain for now. Whereas motor finance suppliers and shoppers are successfully in limbo till September, firms are nonetheless prone to obtain an inflow of complaints, even people who have by no means supplied DCAs. This locations them beneath enormous operational strain.”

She suggested automotive finance companies to plan for the operational affect of coping with these complaints (e.g. useful resource capability), even for these companies who by no means supplied DCA, declaring that the operational affect by way of coping with these may nonetheless be sizable. “Corporations will nonetheless have an obligation to answer shoppers, no matter whether or not they used DCA.” she stated, including that companies ought to contemplate progressing any DCA complaints already acquired, to make sure circumstances are adequately ready in anticipation for the decision.

Martin Lewis stated that some automotive finance companies instructed his researchers that they’ve by no means used DCAs. “We will not independently confirm this,” he stated, “however it’d appear unlikely that regulated companies would make such a blanket assertion except it was true (and if it is not true, we’ll formally complain to the FCA about deceptive information).

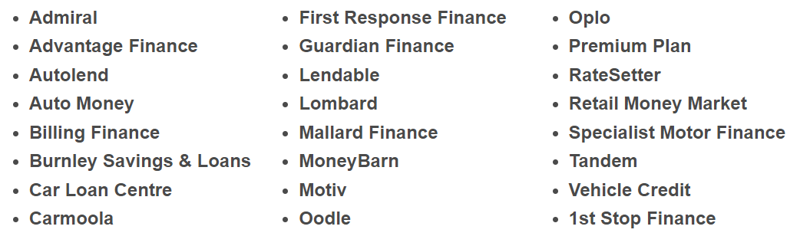

“So in case your automotive finance was with any of those companies, it is in all probability not value making a declare. The present listing is…”

The FCA lately stated it has gone into the assessment with no prior assumption of what it would discover.

The FCA lately stated it has gone into the assessment with no prior assumption of what it would discover.

View the latest FCA’s webinar in full right here.

[ad_2]