[ad_1]

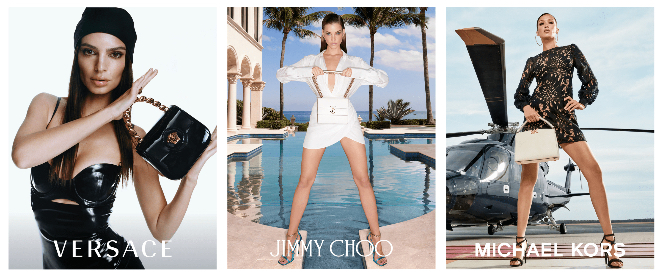

In the case of the pantheon of luxurious conglomerates, Kering and LVMH reign supreme as they every maintain a sizeable portion of the posh vogue and items market. Tapestry, the New-York based mostly dad or mum firm of Coach, Stuart Weitzman and Kate Spade New York is now throwing its hat within the ring after planning to purchase Capri, the proprietor of founder-led labels which embody Jimmy Choo, Michael Kors and Versace, on the finish of final week.

There’s a clear distinction between Tapestry which holds extra American lifestyle-led (maybe “reasonably priced” luxurious) manufacturers which are youthful and trendy as opposed LVMH’s European counterparts that maintain internationally famend powerhouses consisting of distinguished vogue maisons the likes of Louis Vuitton and Dior or Kering’s Gucci and Saint Laurent. Amongst different main components, scale is a part of Tapestry’s new technique.

Learn Extra: Kering Acquires Creed In A “Pure Extension” of The Group’s Luxurious Universe

Reuters studies that luxurious corporations in the USA have “constantly lagged” behind their European friends in scale, limiting their means to compete with LVMH as an example and their 75 manufacturers. One may argue that the acquisition would herald Versace and Jimmy Choo’s clientele of rich customers alongside Michael Kors and Coach’s extra youthful prospects.

Learn Extra: Richemont Group Says No to an Acquisition by LVMH

So far as monetary backing goes, Tapestry has secured US 8 Billion {dollars} from Morgan Stanley and the Financial institution of America. The merger will see the mixed firm change into the fourth largest luxurious firm on this planet with a mixed market share of roughly “5.1 % of the posh items market,” in line with AP Information with world annual gross sales of greater than US 12 Billion, reaching extra prospects worldwide with a presence in additional than 75 nations. Because it stands, Tapestry has a market cap of roughly US 10 Billion {dollars} whereas Capri is sort of US 4 Billion {dollars}.

“The mixture of Coach, Kate Spade, and Stuart Weitzman along with Versace, Jimmy Choo, and Michael Kors creates a brand new highly effective world luxurious home,” Tapestry CEO Joanne Crevoiserat stated in a press release whereas Capri Chairman and CEO John Idol commented “By becoming a member of with Tapestry, we may have better sources and capabilities to speed up the enlargement of our world attain whereas preserving the distinctive DNA of our manufacturers.”

In accordance with the phrases of the all-cash settlement, Tapestry pays Capri shareholders US 57 {dollars} per share. In accordance with Reuters, the deal is predicted to shut in 2024 and is estimated to generate financial savings of greater than US 200 Million {dollars} inside three years of closing.

Learn Extra: Armani Group Achieves Steady Progress Throughout 2022 and Q1 2023

2023 continues to be the 12 months of energy strikes within the luxurious market as Kering purchased a 30 % stake in Valentino for 1.7 Billion Euros in July whereas LVMH is about to sponsor the 2024 Paris Olympics.

For extra on luxurious companies, click on right here

[ad_2]