[ad_1]

The UK’s used automotive market is being held again by youthful automobiles, with the common value of a automotive lower than three years previous (£29,699) contracting 3.5% year-on-year, in accordance with the Auto Dealer Retail Worth Index.

Auto Dealer mentioned that moderately than faltering demand, the value softening amongst youthful automobiles was because of the current easing of provide constraints out there, declaring that ranges of client demand for such automobiles rose 15.1% year-on-year final month, matched by equally strong provide 14.4%. Provide of ‘practically new’ automobiles – these aged beneath 12 months – was up a large 51% over the identical interval.

Costs of youthful used automobiles are additionally being impacted by the present surge in second-hand electrical automobiles (EV) coming into the market. The amount of EVs aged as much as three-years-old marketed on Auto Dealer elevated 97.4% year-on-year final month.

With the common value of a used EV (£31,618) falling 22.6% yyear-on-year in August attributable to provide persevering with to outpace the in any other case very sturdy ranges of client demand for second-hand electrical automobiles, up 68.6% 12 months on 12 months, not solely are the common costs of youthful age cohorts being suppressed, so too is the general market.

Highting the affect of those elements on the headline figures, the common value of petrol and diesel automobiles aged over three-years-old elevated 4.9% 12 months on 12 months final month.

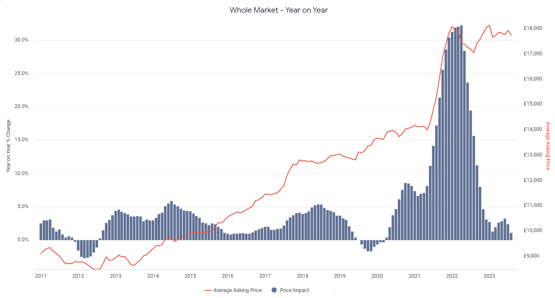

Auto Dealer mentioned that offer is slowly bettering throughout most age cohorts, with total ranges on its platform growing 1.2% in comparison with final 12 months, marking the primary constructive whole market progress since November 2022.

Nonetheless, it famous that offer volumes stay constrained by the three million or so fewer new automobiles that weren’t constructed throughout COVID, and importantly for future retail values, proceed to be outpaced by strong ranges of client urge for food for used automobiles.

In reality, based mostly on Auto Dealer’s Market Perception instrument, which tracks ranges of client engagement on its platform, demand was up 8.7% YoY final month throughout the market.

An extra indicator of the strong ranges of client demand out there is the velocity through which used automobiles are leaving retailers’ forecourts. The most recent knowledge exhibits that used automobiles took a mean of simply 29 days to promote in August: two days sooner than in July, and a day sooner than August final 12 months.

Auto Dealer’s director of information and perception, Richard Walker, mentioned: “We’ve been seeing rising ranges of volatility out there over current months as ranges of COVID associated new automotive provide regularly improves. Nonetheless, headline figures might be deceiving, and as ever the satan is within the element, as a result of opposite to what it might counsel, the market stays stuffed with pockets of revenue potential. Our figures ought to function a clarion name for retailers: in such a nuanced promote it’s very important to observe the info, and never the headlines to tell pricing and stocking methods.

“As provide ranges of youthful inventory improves, notably of electrical automobiles, it’s doubtless we’ll proceed to see a softening in costs over the approaching months. Nonetheless, with no signal of a dramatic change in client appetites, there’s definitely no indication of costs falling off a figurative cliff edge. There’s nonetheless very sturdy pricing pockets accessible, together with with used EVs – the demand is there, so if retailers use knowledge to purchase them and promote them on the proper value, there’s loads of revenue potential accessible.”

[ad_2]