[ad_1]

Auto Dealer’s newest knowledge reveals that shopper demand stays strong, with all segments of the second-hand market recording progress on 2022 ranges because the quietest buying and selling interval of the calendar kicks in.

Common used automobile costs contracted 1% in mid-November on a month-on-month foundation, largely following typical pre-pandemic seasonal developments, based on the web market.

Even so, on a year-on-year foundation, the info exhibits sturdy worth progress in a major proportion of the used retail market. Automobiles aged above 5 years previous elevated 2.2% year-on-year (YoY) on the November mid-month level, while these aged over a decade are up 8.4%.

Highlighting the present nuance of the market, nevertheless, Auto Dealer famous that the common worth of vehicles aged beneath 5 years previous are down 4.5% YoY, due, partly, to the elevated provide of youthful automobiles over latest months, in addition to rising stress from new-car offers. Because of the softening in youthful automobiles, the general complete market determine is being pulled down, contracting -2.3% to this point this month.

It mentioned that opposite to some latest hypothesis, the used automobile market stays resilient, with present shopper demand on its on-line market rising YoY in all segments, together with totally different age teams, and gasoline varieties.

At a complete market stage, Auto Dealer mentioned demand is up 6.9% on November 2022, whereas provide is up simply 3.2% and due to this slight imbalance, its Market Well being metric – which determines the potential profitability of used vehicles primarily based on real-time provide and demand dynamics – is up a sturdy 3.6% versus final yr.

This imbalance in provide and demand can also be at play at a extra granular stage, and in some instances, to a extra vital diploma. Certainly, while provide ranges are down -6.9% YoY in vehicles aged 1-3 years previous in mid-November, shopper demand is up 9.5% on the identical interval final yr, which is leading to a major 17.5% YoY improve in Market Well being.

For these practically new vehicles, aged beneath 12 months, provide continues to develop, rising 29.9% YoY to this point this month. Nevertheless, it’s being outpaced by the very sturdy shopper urge for food for these younger vehicles, with demand up 31.7%, inflicting Market Well being to extend a good 1.4%.

It is a largely related image throughout gasoline varieties, with demand rising in each ICE and alternatively fuelled automobiles. Nevertheless, while demand for petrol and diesel vehicles are recording comparatively conservative ranges of progress at 2.7% YoY and 0.7% respectively, curiosity for low emission vehicles listed on Auto Dealer has rocketed; by mid-month, demand for plug-in hybrid and full/gentle hybrids have been up 37.6% and 51.1% respectively.

Fuelled by the attractive mixture of improved affordability and availability, shopper engagement for totally electrical vehicles on Auto Dealer is up an enormous 69.1% on November final yr.

And with the provision progress of EVs now easing to only 12.9% YoY (from the document excessive of 303% in January 2023), the imbalance is leading to an enormous 49.7% improve in Market Well being – the best recorded since March 2022.

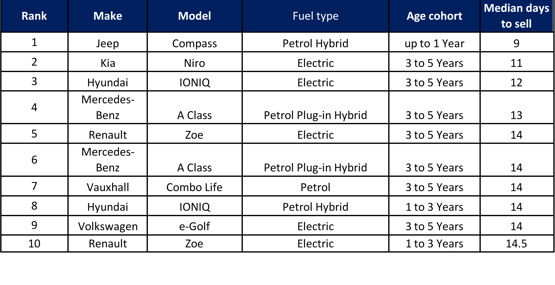

The general demand of the retail market can also be mirrored within the present pace through which used vehicles are leaving retailers’ forecourts. On common, vehicles are taking simply 31 days to promote in November, which is identical pace because the final three years however is quicker than pre-pandemic November 2019 (33). Of the entire gasoline varieties, electrical vehicles are taking the least period of time to promote, at present taking a mean of simply 25 days, in comparison with 31 for each petrol and diesel. What’s extra, of the highest 10 quickest promoting fashions, 5 are electrical, and 4 are hybrid.

Commenting, Auto Dealer’s director of knowledge and insights, Richard Walker, mentioned: “Though the youthful finish of the market is being squeezed by rising provide ranges and renewed stress from new automobile affords, it’s promising to see that shopper engagement from our 10 million month-to-month guests stays strong throughout all segments of the market.

“Used automobile provide is rising, however critically it stays behind demand, which makes any sudden or vital drop in retail costs unlikely. With a big proportion of the market nonetheless recording sturdy worth progress, automobile patrons are clearly ready to pay the retail market worth, and so I’d urge retailers to not danger revenue potential or a self-fulfilling prophecy by making knee jerk reactions primarily based on developments in commerce values.

“Automobiles proceed to promote, and importantly, rapidly – by shopping for and promoting quick, there’s little time for small modifications in worth to be felt. So, my recommendation stays unchanged; worth to the market to promote rapidly, and don’t quit your income unnecessarily, comply with the info.”

High 10 quickest promoting used vehicles as much as seventeenth November

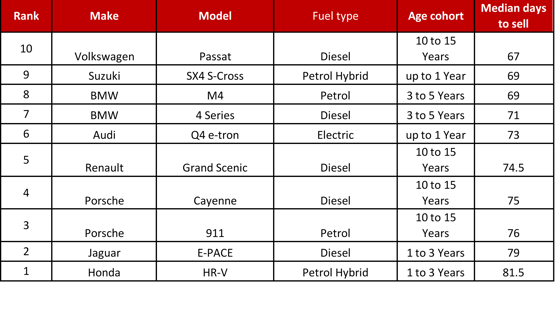

High 10 slowest promoting used vehicles as much as sixteenth November 2023

High 10 slowest promoting used vehicles as much as sixteenth November 2023

[ad_2]