[ad_1]

Tesla’s (TSLA) stock within the US has reached a brand new excessive, which is worrisome right now within the quarter, and it’s pointing to cost cuts possibly not working in addition to the automaker supposed.

Because the starting of the yr, Tesla has persistently diminished costs of its electrical automobiles within the US to create extra demand.

In some instances, costs had been reduce by over 20%.

Throughout its earnings name final week, the automaker made it clear that it’s monitoring new orders day by day towards manufacturing capability, and it plans to proceed adjusting costs with the intention to create the demand to match the manufacturing charge.

Sadly, there’s no straightforward strategy to observe these metrics, however there’s a strategy to observe Tesla’s stock within the US, which can provide us a normal concept.

On the finish of final quarter, Tesla disclosed having 15 days’ value of stock, which has been its highest in years. The automaker tried to justify it with automobiles in transit, nevertheless it’s laborious to consider there have been that many automobiles in transit on the finish of the quarter.

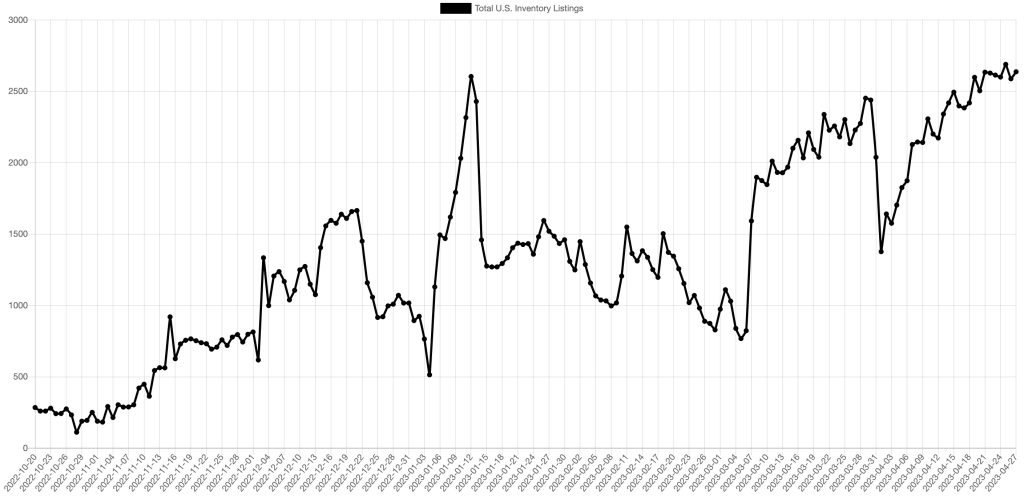

Positive sufficient, new stock knowledge, which doesn’t embrace automobiles in transit, tracked by Matt Jung exhibits that Tesla’s new stock automobiles within the US have reached a brand new excessive of round 2,600 automobiles:

We will see a giant drop on the finish of the quarter and after Tesla’s second-to-most current worth drop, however regardless of a second worth drop this month, the stock seems to maintain climbing.

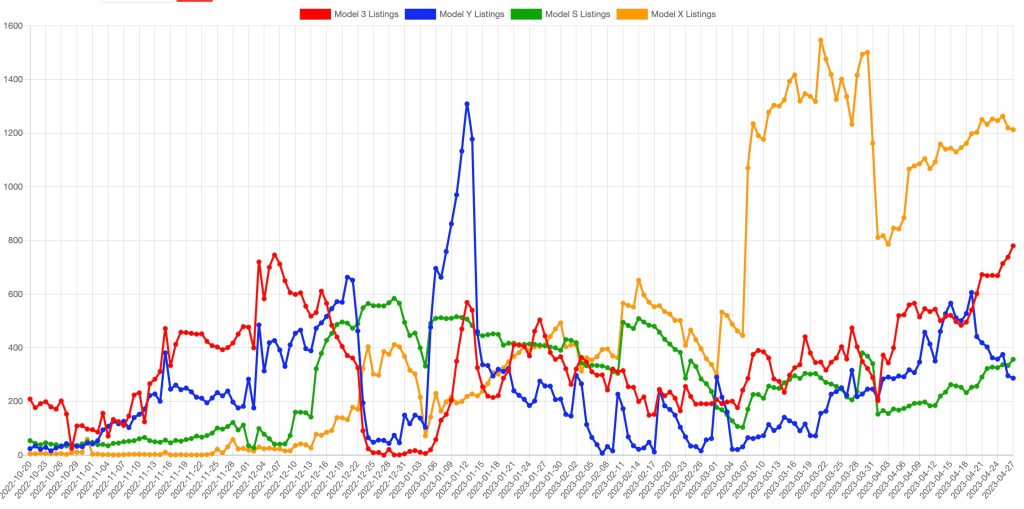

Curiously, Tesla’s largest drawback seems to be the Mannequin X:

The automaker seems to be caught with over 1,200 Mannequin X automobiles on stock within the US.

Mannequin 3 additionally seems to begin being an issue with stock leaping 50% over the second half of the month regardless of the current worth cuts.

The one excellent news is that the value cuts seem to have labored for the Mannequin Y, which is now Tesla’s best-selling car.

Mannequin Y stock was reduce in half to about simply 300 items following the 2 most up-to-date worth cuts.

Electrek’s Take

Now it’s necessary to take these knowledge factors with a grain of salt since in addition they may be a results of Tesla deploying extra stock within the US throughout a brief time period forward of switching manufacturing for different markets.

However no matter that, basically, larger stock is actually not a very good signal for demand.

It is going to be attention-grabbing to see if Tesla decides to once more modify costs down within the US – particularly for Mannequin X.

Though in relation to the electrical SUV, Tesla’s current provide of six years of Supercharging for homeowners of older Mannequin S and Mannequin X automobiles to improve might need executed the trick already, and it has but to be mirrored within the stock automobiles.

FTC: We use earnings incomes auto affiliate hyperlinks. Extra.

[ad_2]