[ad_1]

Used automobiles ended Q1 with a 3rd successive month of rising values at BCA auctions after what chief working officer Stuart Pearson described as a “very encouraging begin to 2023”.

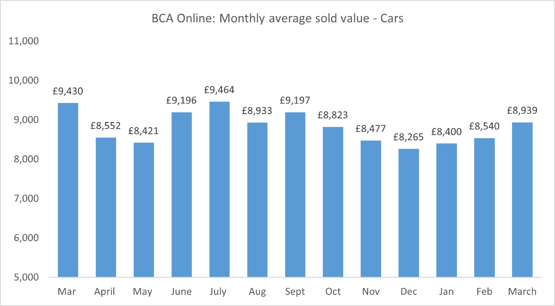

Automobile values rose 4.7% (£399) to common £8,939 throughout BCA’s remarketing operations in March regardless of a rise in sale volumes, as a sector buying and selling towards the backdrop of a cost-of-living disaster “shocked some commentators”, based on Pearson.

And his observations got here as automotive retailers advised Startline Motor Finance’s month-to-month Used Automobile Tracker survey that greater than a 3rd (35%) that this yr was turning out higher than they anticipated.

Pearson stated: “There’s positively been a sense of seasonality for the used automotive sector since Christmas which has helped to ship a really optimistic first quarter efficiency with rising demand and enhancing values.

Pearson stated: “There’s positively been a sense of seasonality for the used automotive sector since Christmas which has helped to ship a really optimistic first quarter efficiency with rising demand and enhancing values.

“Given the financial background and persevering with pressures on family budgets, it has been a really encouraging begin to 2023 throughout the used automotive market and one which has, maybe, shocked some commentators.”

He added: “The Easter buying and selling interval, whereas usually a watershed second for used automotive values, has seen buying and selling stay very optimistic. Whereas the approaching weeks will probably ship some worth erosion to the general market, we’re many months from seeing normalised provide ranges.

“Our expectation is that used automotive values will stay strong for a while to return and we’ll proceed to work very intently with our prospects because the market develops.”

Regardless of its optimistic evaluation of the used automotive sector, BCA stated Q1 had remained risky for electrical car (EV) pricing.

Nevertheless, it added that many fashions had “levelled out” in direction of the top of the interval and demand has improved, regardless of elevated provide.

Cap HPI director of valuations Derren Martin alluded to this model-by mannequin variance in his mid-month catch-up with AM earlier this week, through which he revealed that the value declines amongst lots of the market’s extra premium EVs had began to sluggish.

EVs shall be one space that retailers are eyeing intently as they search to develop their inventories to take care of profitability in 2023.

Whereas Startline’s newest survey indicated a optimistic begin to the yr, with 15% sustaining profitability and stating that 12% that inventory availability was enhancing, 32% stated staying worthwhile was proving troublesome with 62% including that inventory provide stays an issue.

Startline Motor Finance chief govt Paul Burgess stated: “It’s in all probability a measure of how low expectations have been throughout each the used automotive sector and the broader financial system {that a} vital minority of sellers are saying that this yr has, to this point, been one thing of nice shock.

Startline Motor Finance chief govt Paul Burgess stated: “It’s in all probability a measure of how low expectations have been throughout each the used automotive sector and the broader financial system {that a} vital minority of sellers are saying that this yr has, to this point, been one thing of nice shock.

“Definitely, whereas circumstances should not as unhealthy as some specialists predicted, they nonetheless stay robust.”

He added: “The used automotive sector stays remarkably resilient however there is no such thing as a query that the majority sellers are having to work exhausting to generate income and frequently discover new methods of maximising the potential of their enterprise towards a troublesome backdrop.”

[ad_2]